Investing can be confusing.

Luckily, there are a few ways to make it easier.

This article walks through one of my favorite strategies to simplify (and automate) the investing process - the 3-fund portfolio.

To get started investing, the steps are always the same.

First, you have to choose which type of account is best for your investment goals.

This would include a Roth or Traditional IRA, a taxable brokerage account, Solo 401(k), or any other type of investment account.

.webp)

I wrote a separate post that breaks down the pros & cons of each type of account which you can read here

After selecting an account, then you can start to pick your investments (also known as 'creating a portfolio').

Traditionally, people view investing as a way to pick stocks, hopefully get lucky, and make a lot of money.

Instead of viewing the stock market as a casino, try to view it as a way to invest in the growth of society.

It can be hard to have a positive outlook with where we're at right now, but we only have two options - progress forward & keep growing, or slowly deteriorate.

If we deteriorate, investing will be the last of our worries.

If we progress forward & keep growing as a society, it would be wise to bet on and invest in that growth.

So, how do you invest in the growth of society?

By picking a diverse, global set of investments - which is where the name "3-fund" portfolio comes into play.

The idea is that rather than trying to pick stocks, you invest your money in a few broad, diverse funds that aim to match what the market is doing.

You may not be familiar with the term "fund", so here's a quick visual breakdown:

.webp)

A fund can help reduce risk because instead of betting on the success of one company, you're betting on the success of a collective group of companies.

For example, if Apple stock went down 30% in one day and that was your only investment, you could be in a tough spot.

But if you invest in all of the biggest stocks at the same time with a fund, the chance that every single stock goes down is a lot lower.

So overall, a 3-fund portfolio is a way to get invested in the stock market without having to pick individual stocks.

The goal is to build a simple, well-rounded set of investments that you don't have to frequently check on. You have better things to do than research stocks and worry about prices every day.

A "hands-off" investment portfolio typically consists of:

Now, depending on where you're at in life, this may or may not be the right investment selection for you.

If you're in your 20s and have a few decades before retirement, you probably shouldn't own any "bonds" because they're designed to provide lower, more stable returns (which is helpful for retirees who need to live off their investment income).

To help decide which ones may be right for you, here's a quick breakdown of the most popular options:

Total stock market - Aims to track all stocks in the U.S. stock market, commonly based on the performance of CRSP US Total Market Index which includes nearly 4,000 stocks

S&P 500 - Owning stocks in the S&P 500 Index, which represents 500 of the largest U.S. companies

Small Cap - Aims to track the performance of "small" companies, which is a market value between $250 million and $2 billion

International - Aiming to diversify and get exposure across developed and emerging non-U.S. stock markets

Global - A combination of total stock market & international, aiming to invest in companies across the globe

Bonds - Aims to track the performance of a broad bond index while providing less volatile returns than stock funds

To find different funds to buy, you can start with a simple Google Search.

If you want to buy an S&P 500 fund, search "s&p 500 index fund", and start looking through the different options. I recommend looking at Vanguard or Fidelity funds as they offer low fees and a variety of investment options.

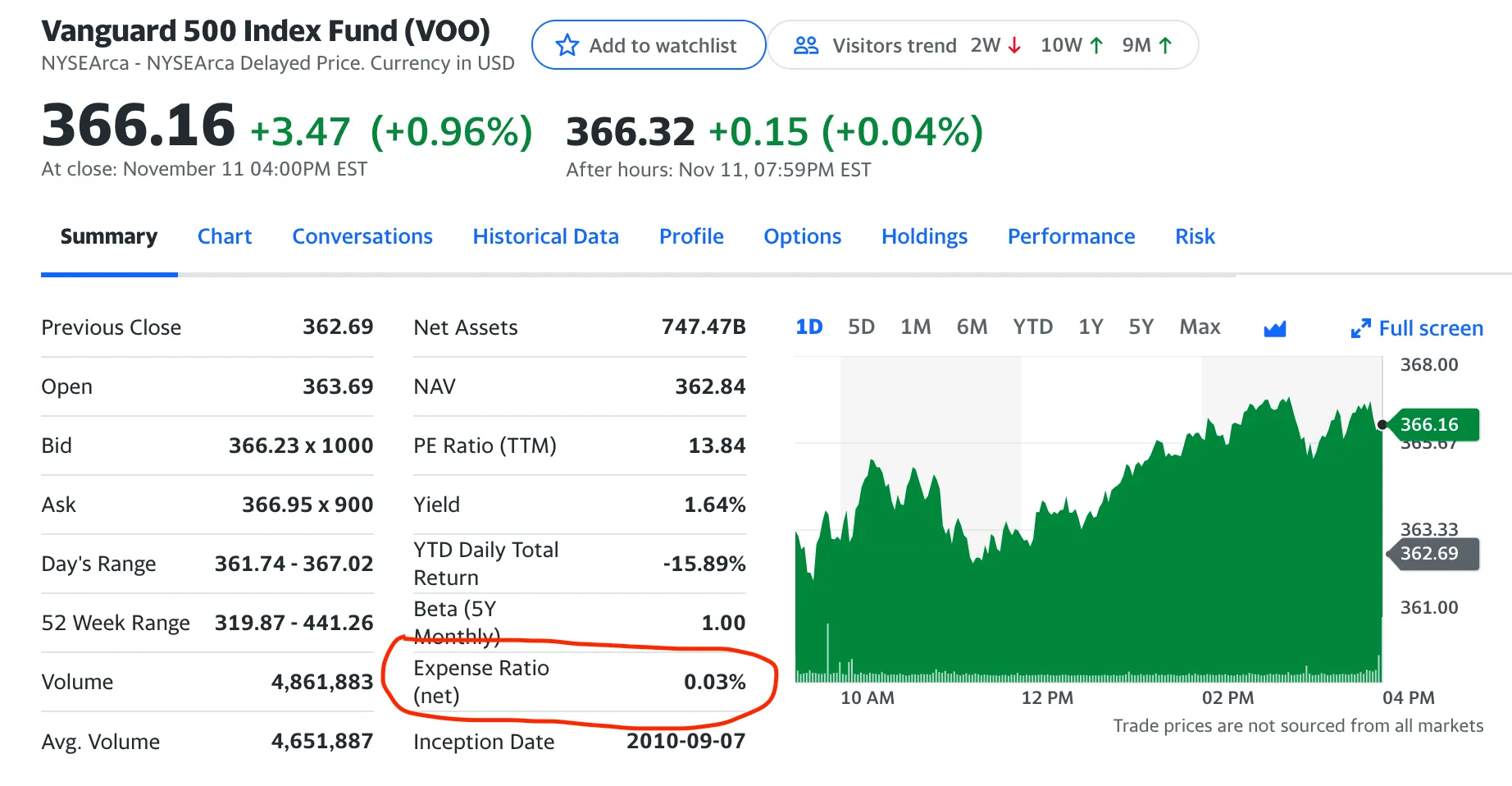

The most important thing to look for when doing research is the fund's expense ratio - which is essentially the annual fee for owning that investment.

All investment platforms should show the number but if you were doing research & looking at Yahoo Finance, this is where you'd find it:

I'd be hesitant to invest in anything that has higher than a 0.50% expense ratio because the higher the fees, the lower your total return.

To find these funds within your actual investment account, you'd search that weird, three to five letter phrase after the fund's name - also known as a "ticker symbol".

For example, Apple's ticker symbol is $AAPL. The Vanguard S&P 500 Index Fund (above) is $VOO.

You also want to check out each fund's performance over time, while also comparing the expense ratios, to get the most value for your dollar.

So if you were using Vanguard as your investment company, this is how you'd get started investing:

If you had $10,000 to invest, you may want to buy 65% S&P 500 ETF ($6,500), 15% US small cap ETF ($1,500), 20% international ETF ($2,000).

.webp)

Since most platforms let you buy "fractional" shares, you should be able to type in the dollar amount you want to buy and it'll automatically buy the correct number of shares (even if it's not a full number, like 24.5294 shares). Then, you can set up automatic contributions every month so that a certain amount of money gets deposited & invested in the funds you chose no matter what.

You may want to make manual contributions initially, but I highly recommend setting up a recurring deposit.

It helps remove the human error from trying to remember to transfer money every month and it guarantees that you're setting aside money for your future self.

You'll need to evaluate your monthly spending and income to see how much you can afford to transfer each month, but you want to aim for saving at least 15-20% of your income. You may not be able to do that right away, but it's a target to work towards.

And all 20% doesn't have to go towards investments. You may prefer to have more cash on hand, or you may be saving for a short term goal - your savings situation will evolve over time and that's normal.

But this is an example of what it setting up an automated recurring transfer looks like in Vanguard:

Once you set up your portfolio and make automated contributions, you won't have to regularly check it - but you still want to stay on top it.

You should make it a regular practice to review your account(s) quarterly or annually so that they're not always top of mind, but you have a decent understanding of how they're performing. I'd set a recurring calendar event for whatever frequency you decide on.

When reviewing your investments, an important strategy to keep in mind is rebalancing.

You may not have to do it often if you keep a simple investment selection, but rebalancing is the process of buying & selling investments to keep them at desired levels.

For example, in the Vanguard portfolio above, we outlined a 65/15/20 allocation. If the stock market was performing well in America but small business and international stocks were down, your portfolio may end up being too heavily weighted towards U.S. stocks (85% for example). You'd then want to rebalance your portfolio by selling some of the U.S. stock fund and buy back more of the international stock & small cap funds to bring it back to a 65%/15%/20% allocation.

Tax-loss harvesting is another strategy where you intentionally sell some investments at a loss to offset the gains from other investments to reduce your tax bill. These strategies can be difficult to implement without experience, but there are a lot of great resources & walkthroughs out there.

Overall, if you keep your investment selection simple and take a long-term approach, investing should be a simple activity that primarily operates in the background. You don't need to check your portfolio every day and you don't have to react to every breaking news story.

You can automate your contributions, set your investment selections, and sit back while time & compound returns do their thing.

With a 3-fund portfolio, you can simplify your investing decisions & make it easy to get into the market.